Fascination About San Diego Home Insurance

Fascination About San Diego Home Insurance

Blog Article

Protect Your Home and Possessions With Comprehensive Home Insurance Policy Insurance Coverage

Comprehending Home Insurance Policy Coverage

Comprehending Home Insurance Insurance coverage is important for homeowners to protect their residential property and assets in situation of unpredicted events. Home insurance typically covers damages to the physical framework of your home, individual valuables, liability protection, and extra living expenses in case of a covered loss - San Diego Home Insurance. It is essential for home owners to understand the specifics of their policy, including what is covered and left out, policy restrictions, deductibles, and any kind of added recommendations or bikers that might be necessary based on their private scenarios

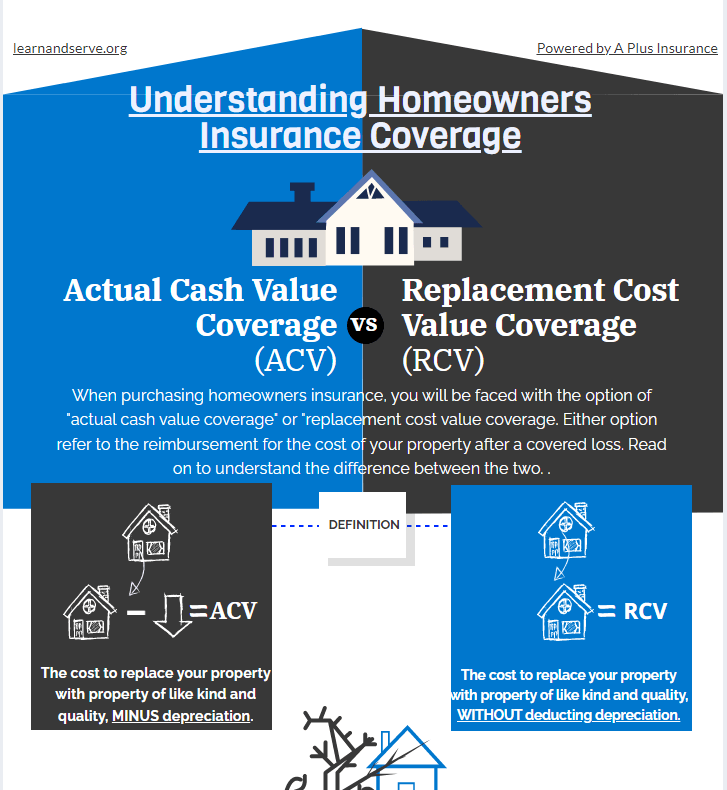

One key aspect of recognizing home insurance policy coverage is knowing the difference in between real money worth (ACV) and replacement expense coverage. House owners should also be aware of any coverage limits, such as for high-value things like fashion jewelry or art work, and consider buying extra protection if needed.

Advantages of Comprehensive Policies

When exploring home insurance coverage, home owners can get a deeper recognition for the defense and peace of mind that comes with detailed policies. Comprehensive home insurance coverage policies use a wide range of advantages that go past basic coverage.

Additionally, comprehensive plans commonly include protection for responsibility, using security in instance somebody is wounded on the building and holds the house owner responsible. This obligation coverage can aid cover clinical bills and legal expenditures, providing further comfort for homeowners. Moreover, thorough policies may also use added living expenses protection, which can assist pay for temporary real estate and various other necessary expenses if the home ends up being unliveable because of a protected occasion. In general, the extensive nature of these plans supplies home owners with durable security and financial security in different situations, making them a valuable investment for securing one's home and properties.

Customizing Insurance Coverage to Your Needs

Tailoring your home insurance policy protection to line up with your certain demands and situations guarantees a reliable and customized securing method for your residential or commercial property and possessions. Personalizing your protection permits you to attend to the distinct aspects of your home and possessions, giving an extra thorough shield against possible risks. By assessing elements such as the worth of your residential property, the components within it, and any extra frameworks on your facilities, you can establish the proper level of coverage required to protect your financial investments effectively. Additionally, personalizing your plan allows you to include certain recommendations or riders to cover items that may not be included in basic plans, such as high-value precious jewelry, art collections, or home-based companies. Understanding your private needs and functioning very closely with your insurance service provider to customize your coverage makes sure that you are appropriately safeguarded in case of unanticipated conditions. Inevitably, tailoring your home insurance coverage supplies comfort understanding that your possessions are guarded according to your unique scenario (San Diego Home Insurance).

Protecting High-Value Possessions

To sufficiently protect high-value assets within your home, it is vital to analyze their worth and consider specialized protection choices that deal with their special value and significance. High-value possessions such as art, jewelry, antiques, and collectibles might exceed the coverage limitations of a common home insurance coverage plan. For that reason, it is critical to collaborate with your insurance coverage service provider to make sure these products are properly secured.

One method to guard high-value possessions is by scheduling a different plan or recommendation particularly for these items. this post This specialized protection can provide higher coverage restrictions and might additionally include added defenses helpful site such as insurance coverage for accidental damages or mysterious loss.

Furthermore, before acquiring protection for high-value properties, it is suggested to have these products expertly appraised to establish their current market value. This evaluation paperwork can help enhance the cases process in the event of a loss and make certain that you receive the ideal compensation to replace or fix your valuable properties. By taking these aggressive steps, you can delight in comfort understanding that your high-value assets are well-protected versus unforeseen circumstances.

Claims Process and Policy Monitoring

Conclusion

Finally, it is important to ensure your home and properties are adequately protected with extensive home insurance protection. By recognizing the protection options offered, tailoring your policy to satisfy your web certain requirements, and protecting high-value assets, you can mitigate threats and prospective financial losses. Furthermore, knowing with the insurance claims procedure and properly handling your plan can aid you navigate any kind of unexpected events that may emerge (San Diego Home Insurance). It is critical to prioritize the security of your home and possessions via extensive insurance policy coverage.

One key element of comprehending home insurance policy protection is recognizing the difference in between actual money value (ACV) and replacement cost protection. Homeowners should likewise be mindful of any type of insurance coverage limits, such as for high-value items like fashion jewelry or art work, and think about acquiring added coverage if required.When discovering home insurance policy coverage, property owners can get a deeper admiration for the protection and tranquility of mind that comes with thorough plans. High-value assets such as fine art, jewelry, antiques, and collectibles may surpass the insurance coverage restrictions of a basic home insurance plan.In final thought, it is important to ensure your home and assets are properly safeguarded with comprehensive home insurance coverage.

Report this page